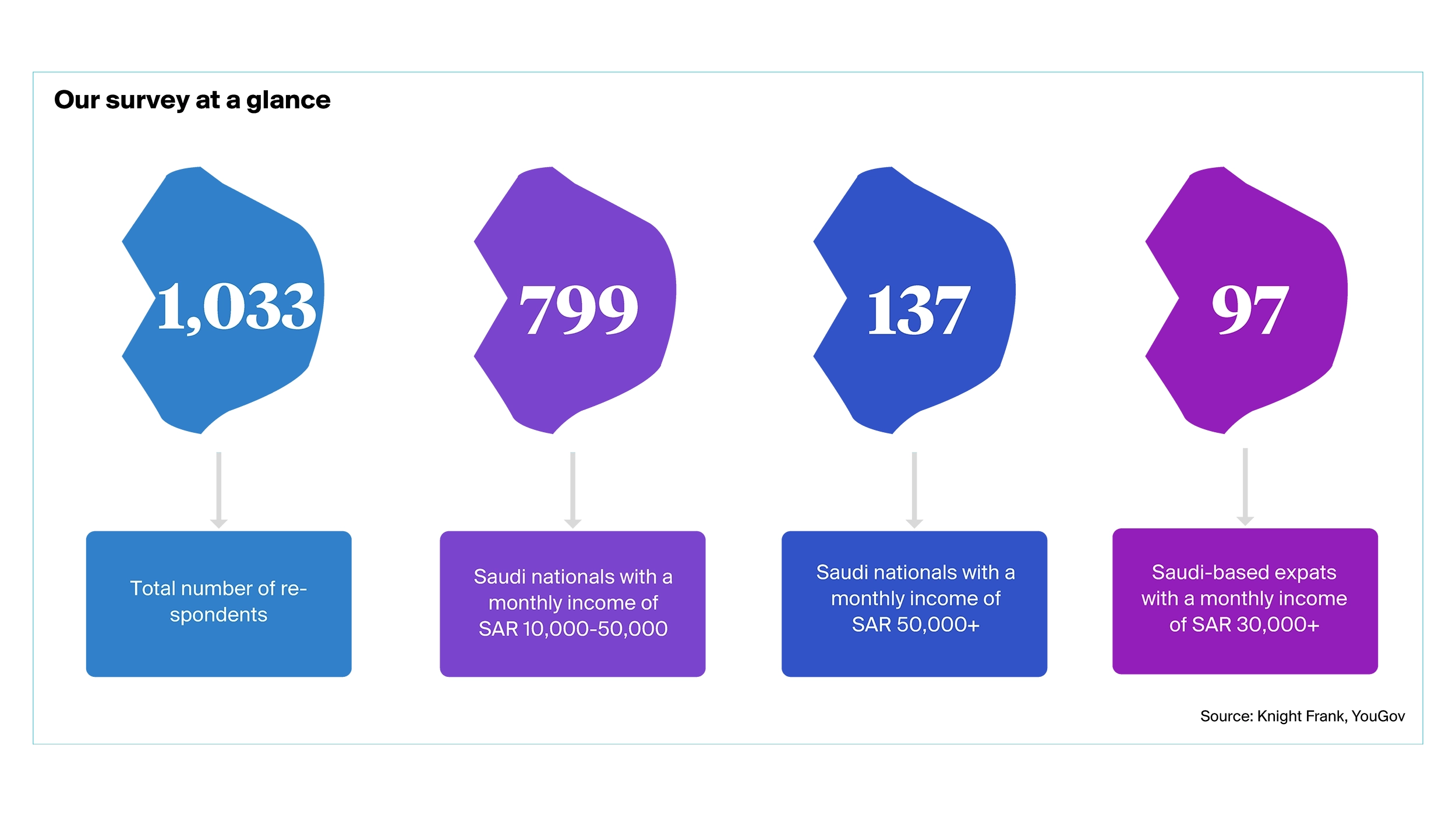

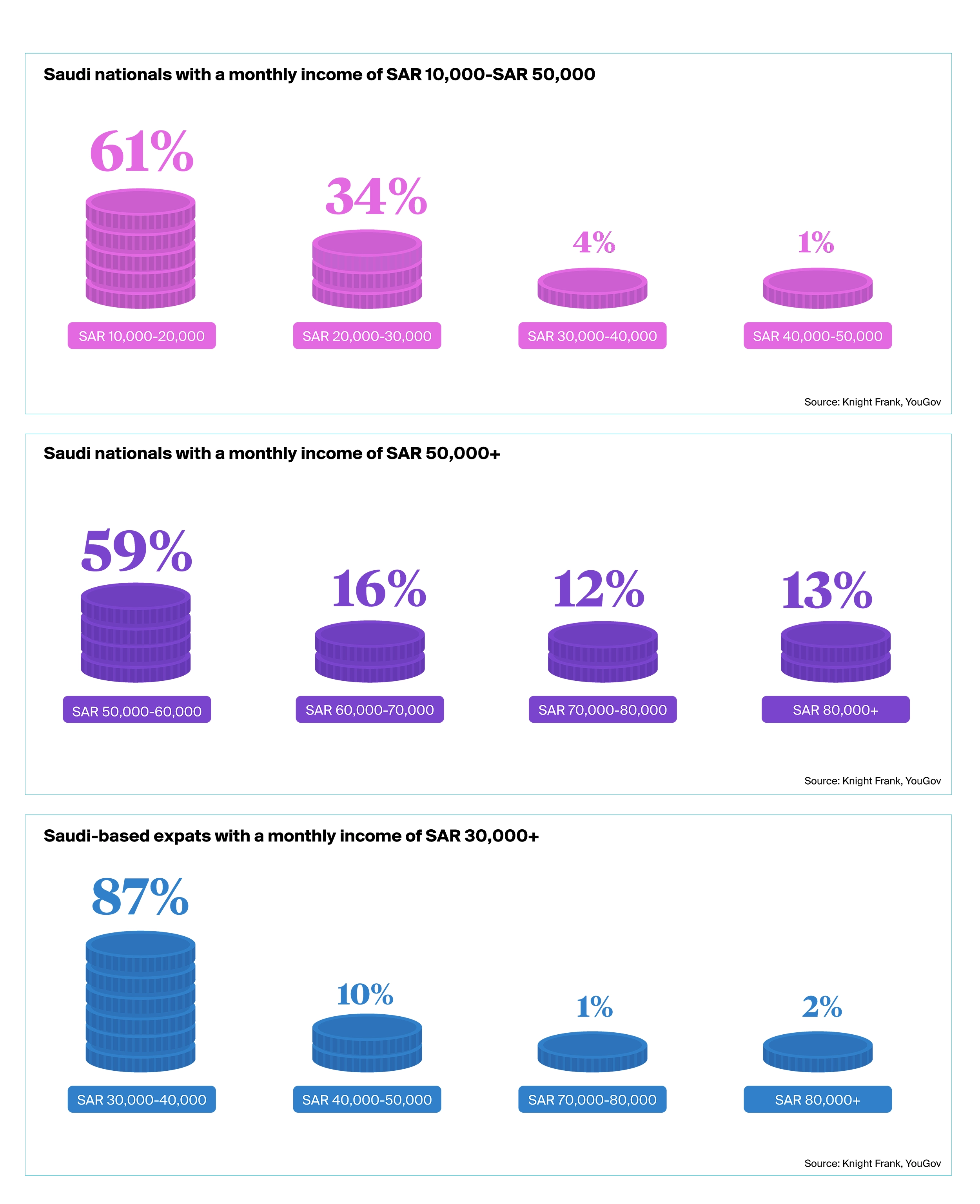

The second set of surveys, focused on non-residential sectors, in our 2025 Saudi Report was conducted in partnership with YouGov. Respondents were divided into three distinct segments: Saudi nationals with a monthly income of SAR 10,000-50,000; Saudi nationals earning over SAR 50,000 per month; and Saudi-based expats with a monthly income above SAR 30,000. These groups were carefully selected to provide insights into attitudes and preferences connected with the Kingdom’s commercial real estate sectors.

We surveyed 1,037 respondents across Saudi Arabia to capture a representative view of demand within the Kingdom’s commercial real estate markets. The sample includes Saudi nationals across multiple income groups and Saudi-based expatriates, offering balanced insight into both domestic and international perspectives shaping Vision 2030’s non-residential sectors.

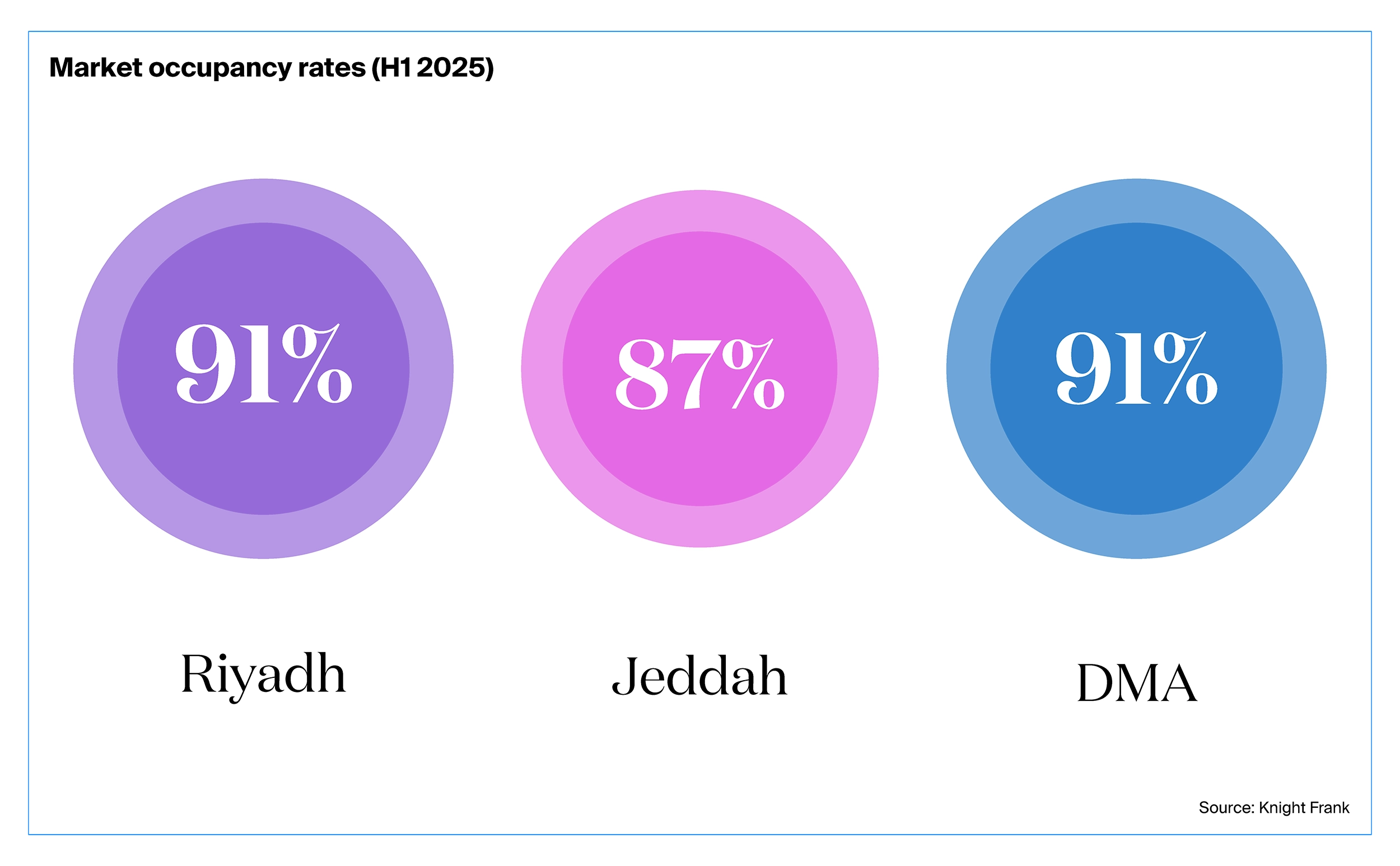

Hospitality Market

Authorities have boosted the Kingdom’s total visitor target to 150 million by 2030, as the initial 100 million goal was breached in 2023. However, domestic travellers continue to account for the lion’s share of tourists, with nearly three-quarters (74.3%) of the 116 million visitors during 2024 being Saudi nationals. This heightened desire to travel domestically is also reflected in our survey results, with 67.5% of our respondents taking a trip within the Kingdom at least once every three months. This figure is higher amongst Saudi nationals (69% v the 65% we reported in 2023).

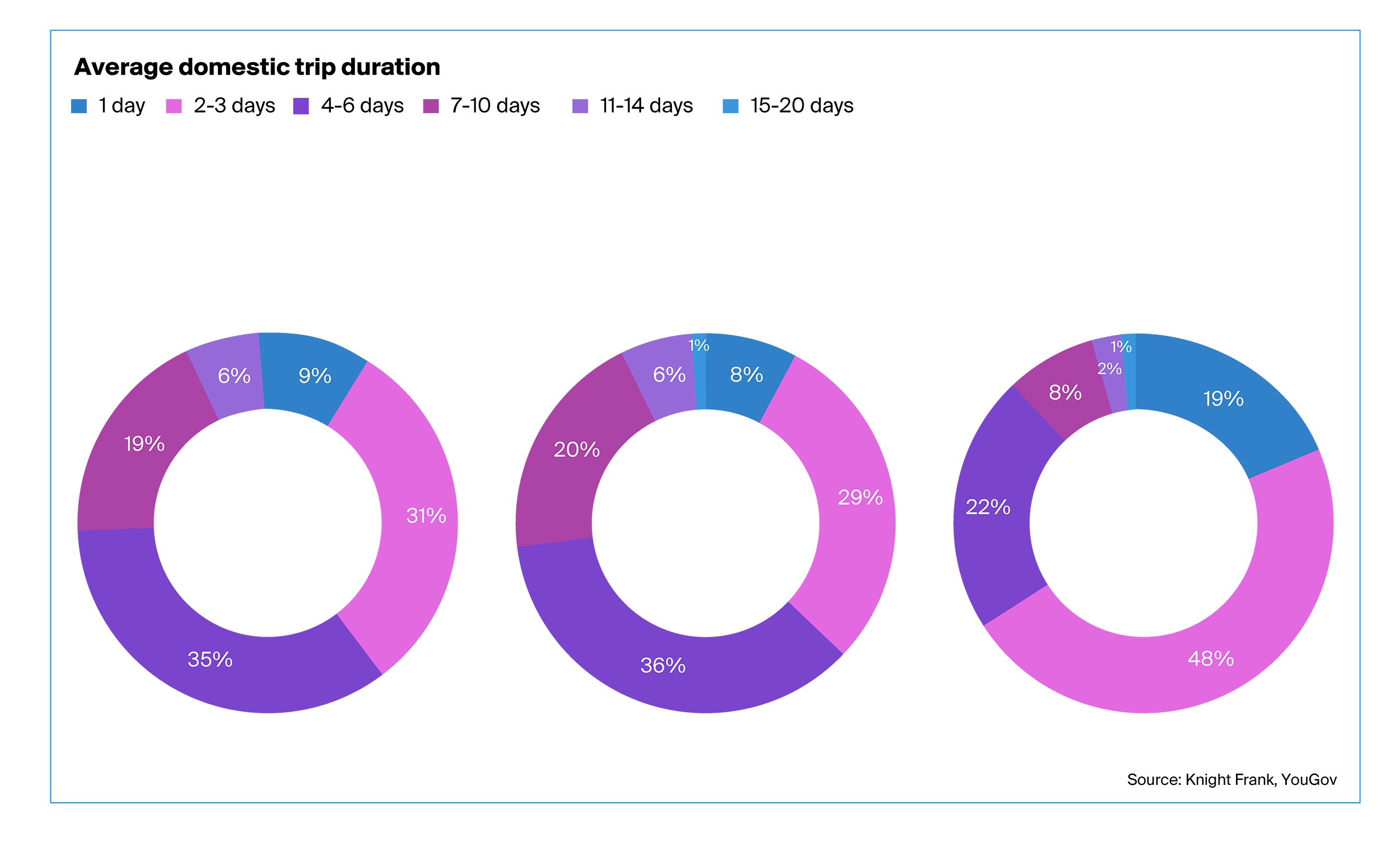

Domestic travel across Saudi Arabia is becoming more frequent but shorter in length, reflecting a growing preference for flexible leisure experiences. Saudi nationals are more inclined toward mid-length stays, typically spanning several days, while expatriates tend to take shorter weekend-style trips.

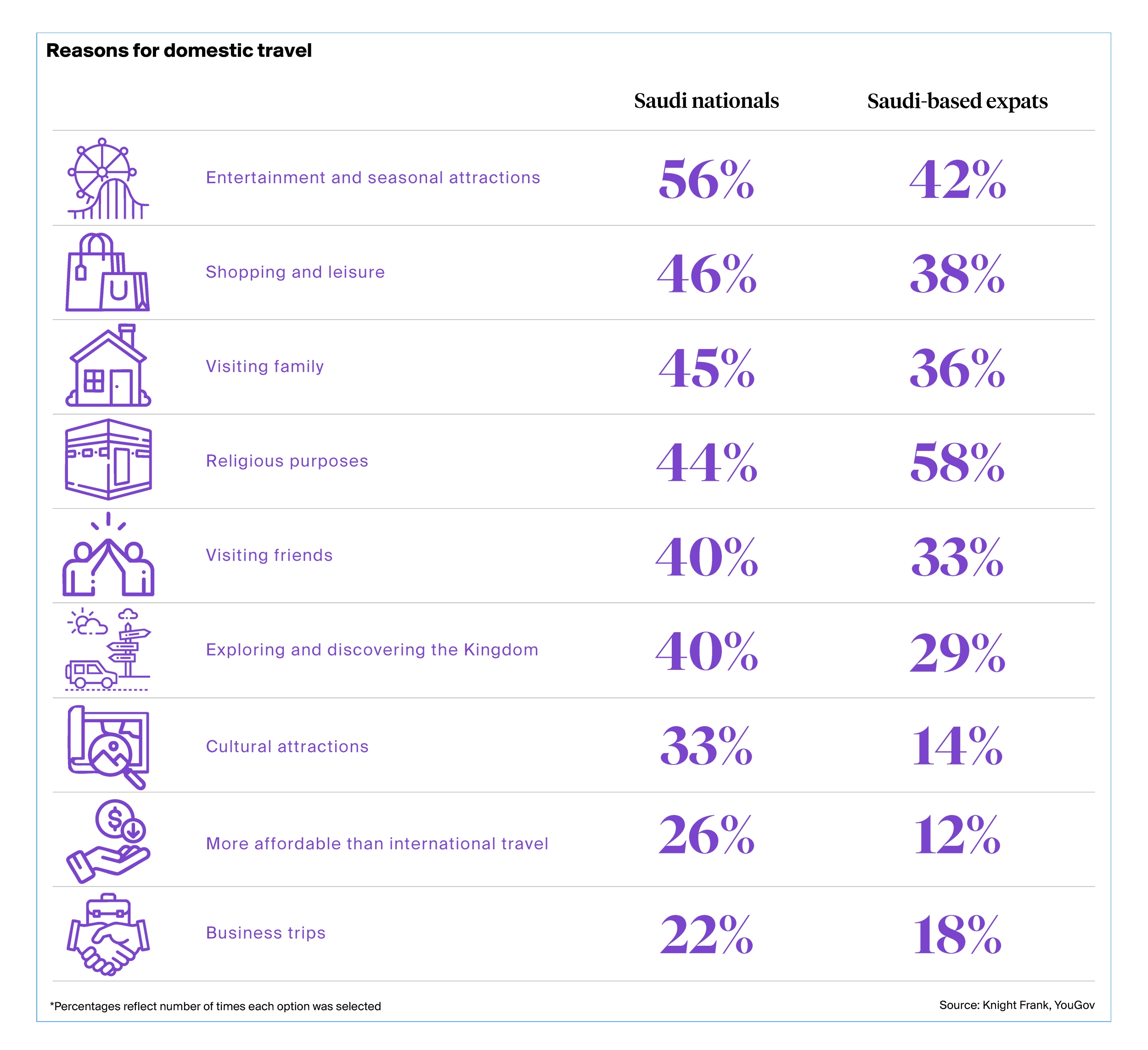

Entertainment and leisure lead domestic travel motivations, followed by shopping and visiting family among Saudi nationals. Expatriates travel mainly for rest and relaxation, reflecting different patterns of how each group engages with destinations across the Kingdom.

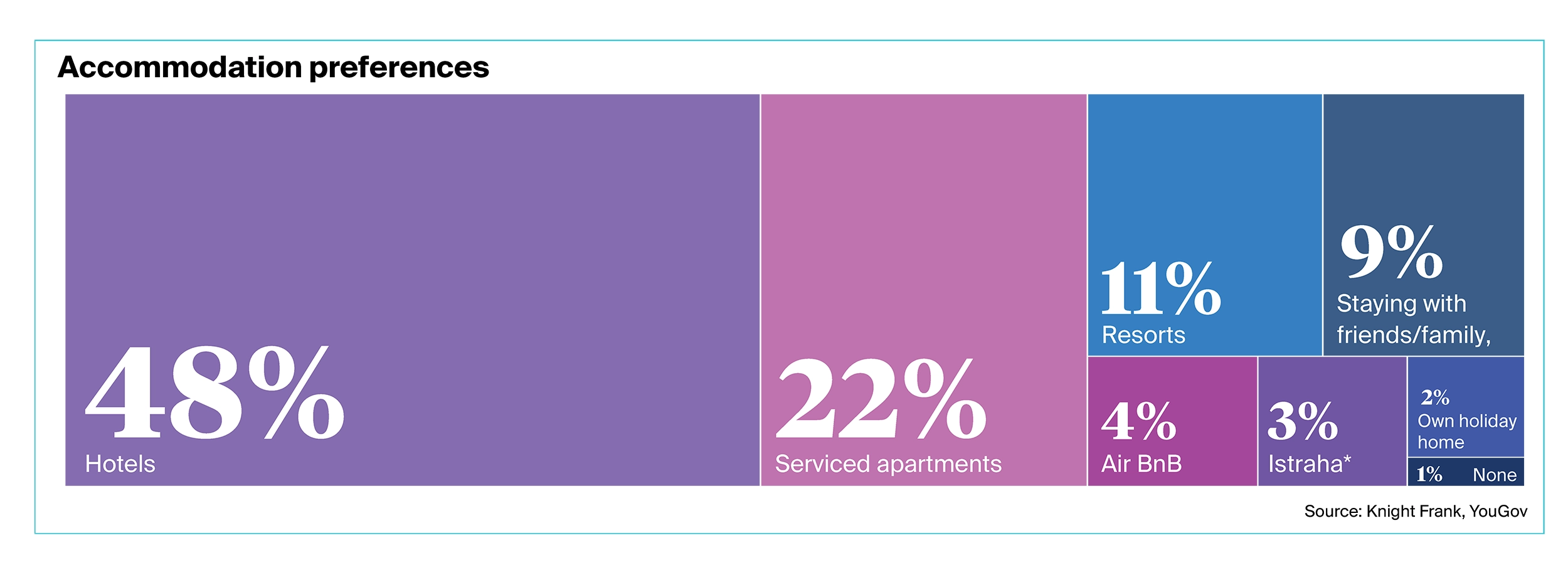

Hotels remain the dominant choice among both Saudi nationals and expatriates living in the Kingdom, with 48% selecting them as their preferred accommodation type. Serviced apartments follow at 22%, reflecting growing interest in more flexible, lifestyle-driven stays. Resorts, private chalets and short-term rentals remain smaller but gradually expanding segments as domestic tourism continues to strengthen.

Entertainment Sector

Saudi Arabia’s entertainment sector has rapidly transformed since cinemas reopened in 2018, marking the start of a new era for leisure and culture in the Kingdom. What began with the return of movie theatres after a long absence has quickly expanded into concerts, festivals, gaming, sporting events, and large-scale attractions. Supported by Vision 2030, the sector has become a core pillar of national development, enhancing the quality of life, boosting tourism, and creating new investment opportunities. Today, the sector constitutes around 6% of the national budget, underscoring its importance as both a cultural enabler and a powerful engine of economic diversification.

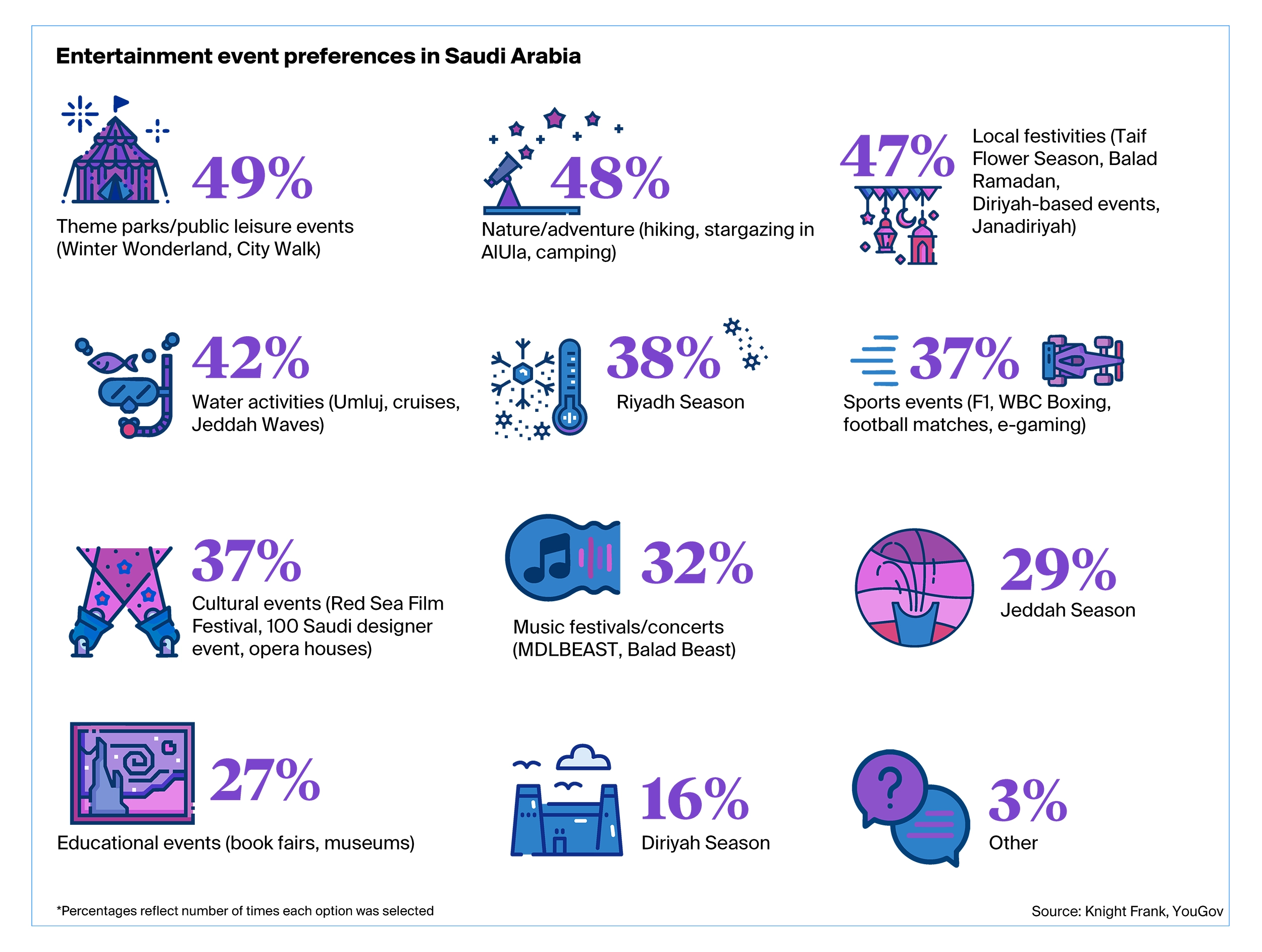

Our survey highlights a strong appetite for family-oriented and culturally rooted entertainment, led by theme parks (49%), nature and adventure activities (48%), and local festivities (47%). Saudi nationals show slightly higher engagement in these categories, while expatriates display broader interest across leisure and cultural experiences.

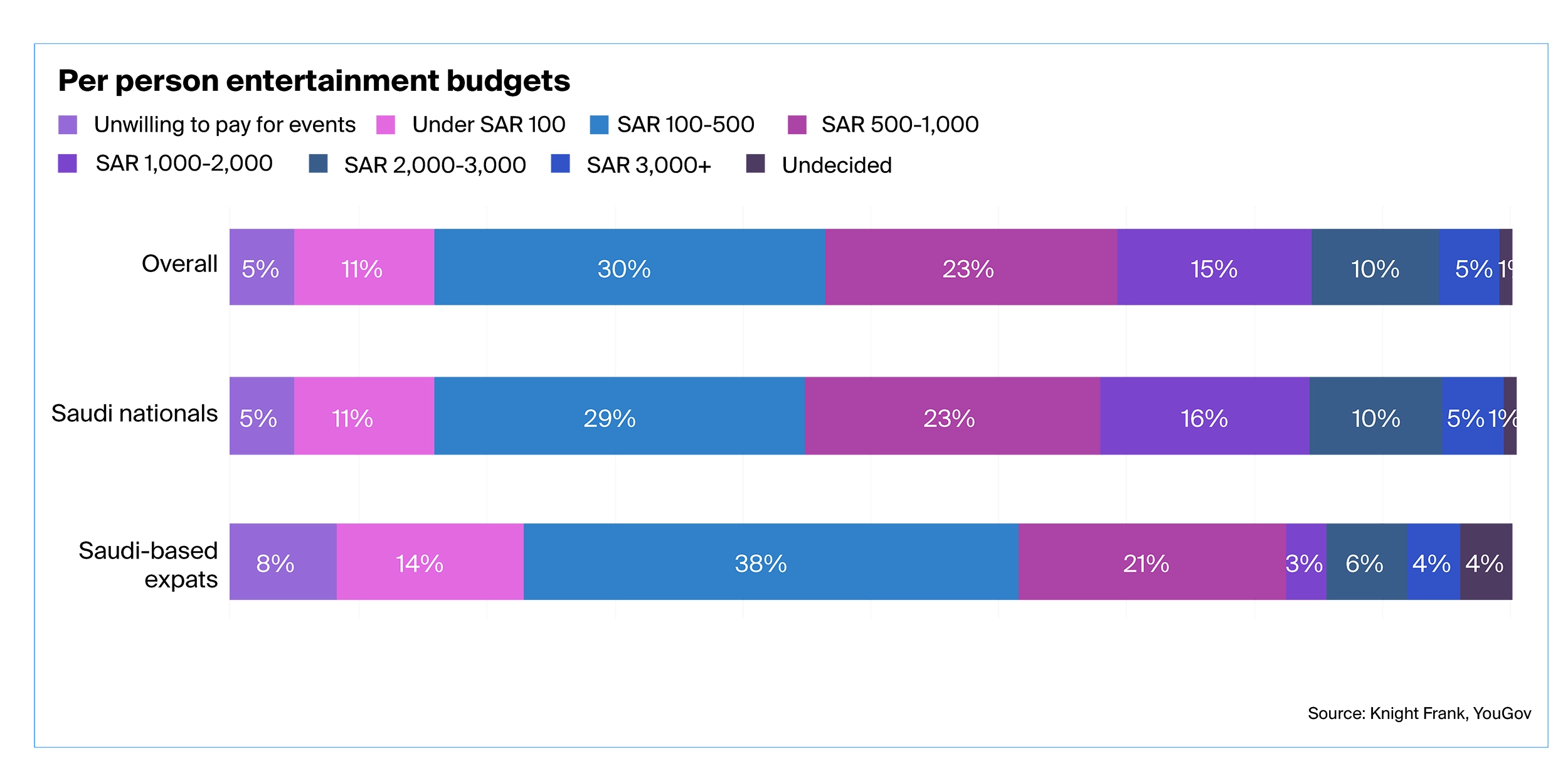

Spending intentions among survey respondents highlight a broad mid-market appetite, with 30% willing to spend SAR 100–500 per person and a further 23% prepared to spend SAR 500–1,000. Only 5% are unwilling to pay for entertainment. Premium spend is emerging: 15% are happy to spend SAR 1,000–2,000, rising to 33% among nationals earning SAR 80,000+ per month and to 27% at SAR 3,000+ among high-income nationals.

Retail

Driven by Vision 2030’s economic transformation agenda, Saudi Arabia’s retail market continues to evolve rapidly, with the country’s young population and accelerated digital adoption underpinning this evolution. The sector’s rapid expansion is best reflected in the growth in consumer spending, which reached SAR 1.41 trillion (US$ 376bn) in 2024, reflecting a 7% year-on-year rise.

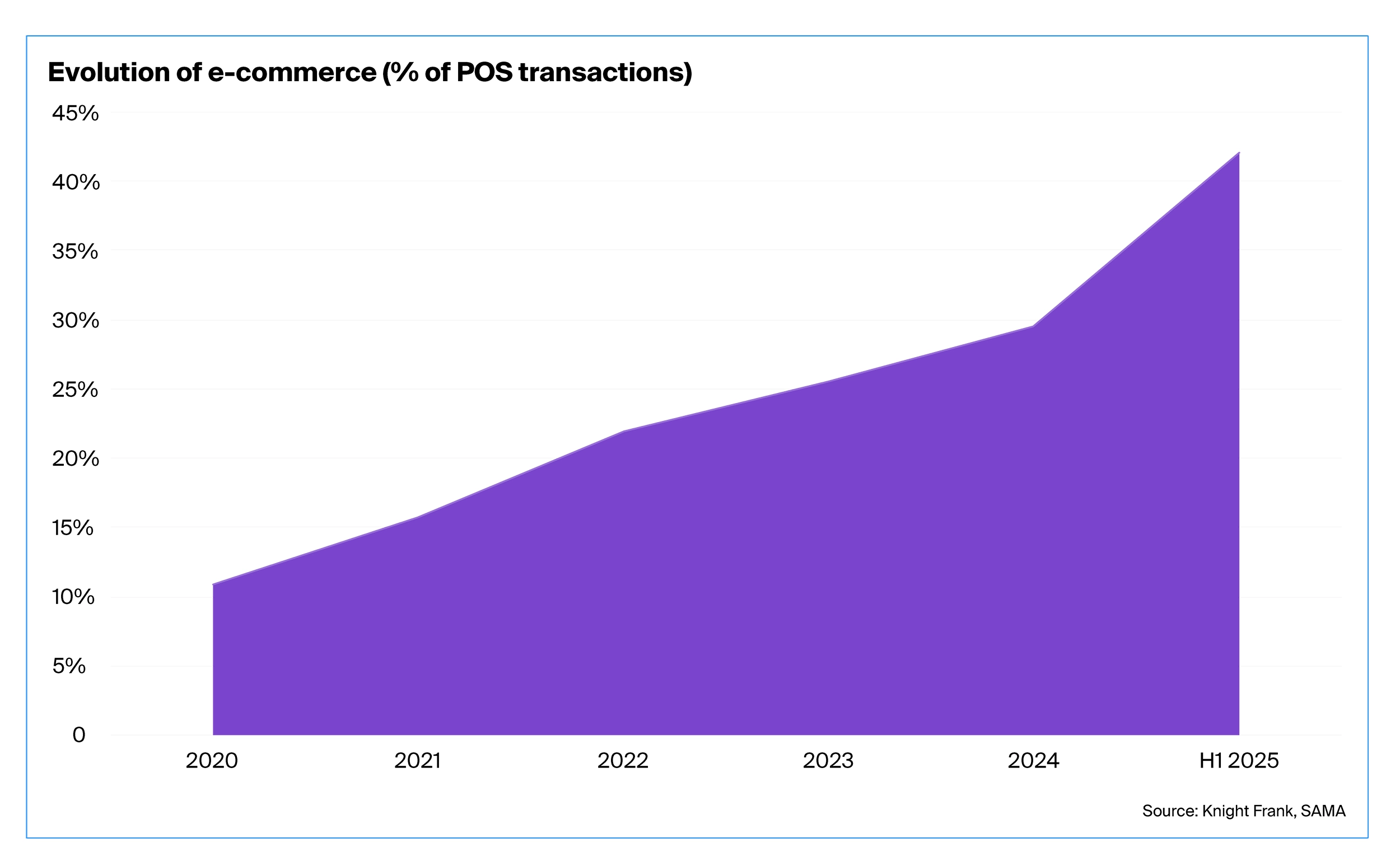

E-commerce has rapidly strengthened its foothold within Saudi Arabia’s retail market, now accounting for nearly 36% of all POS transactions. The value of e-commerce sales reached SAR 41 billion (US$ 10.9 billion) in H1 2025, marking a 42% year-on-year increase, as consumers embrace online platforms for convenience and value. Rising smartphone use, internet penetration, and digital infrastructure investment continue to power this expansion.

Dining-out frequency remains high, with a strong mid-market appetite for casual and quick-service formats. Average spending patterns reveal growing willingness to pay for premium café and restaurant experiences, particularly among younger Saudis and higher-income households seeking quality and social engagement.

Food & Beverage

Saudi Arabia’s F&B sector is evolving rapidly, shaped by the rise of speciality cafés, greater global brand penetration, the expansion of delivery platforms, and a growing demand for healthier, yet convenient options. These trends are redefining how Saudis dine and socialise, reinforcing the sector’s importance within the wider retail ecosystem.

Our survey findings reveal that dining out is a regular social activity across categories, from breakfasts and family meals to celebrations. Spending patterns point to a broad mid-market appetite, with most respondents allocating between SAR 100–300 per person, while higher spending is concentrated around special occasions. Saudi nationals tend to dine out slightly more often and spend more per occasion than expatriates.

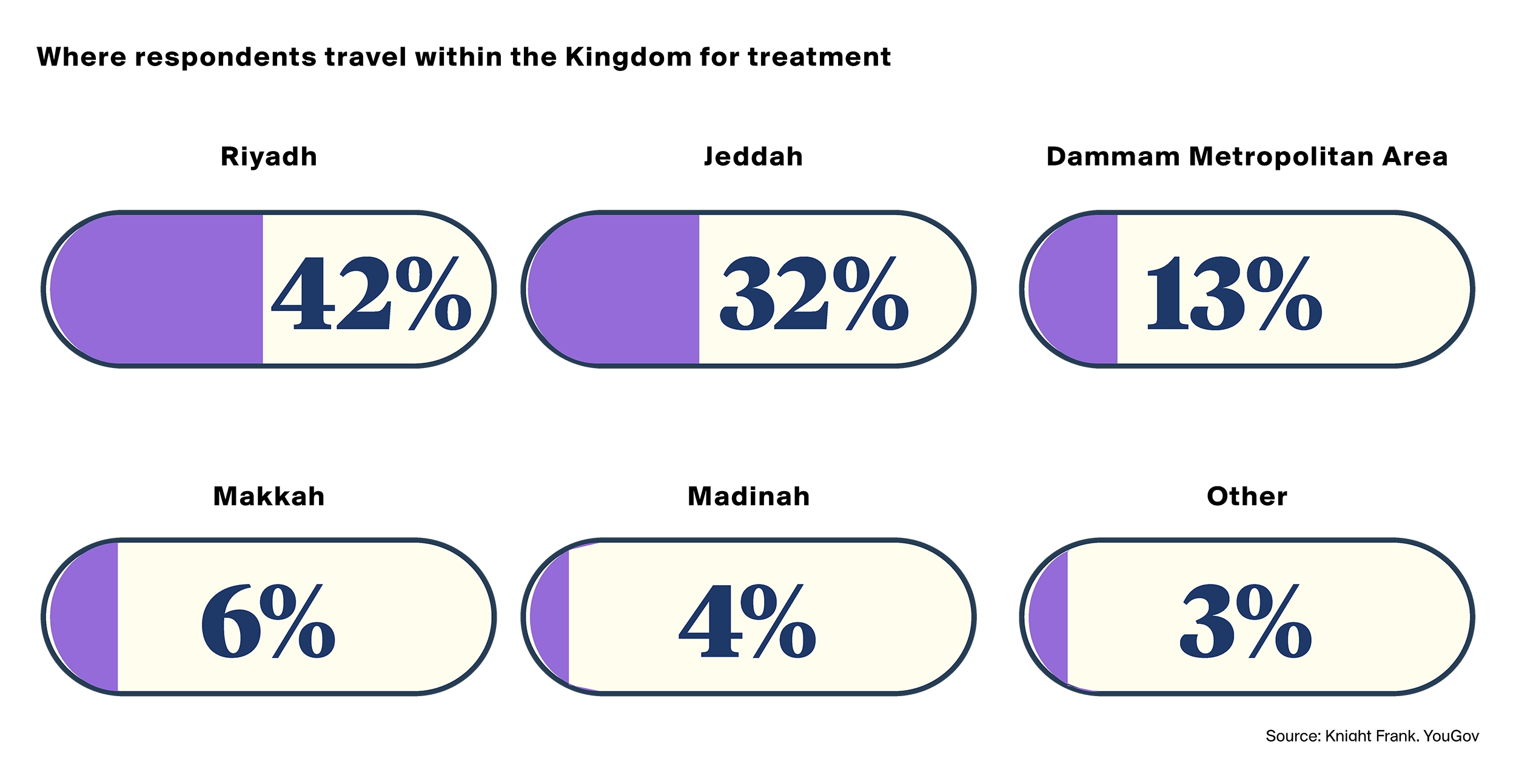

Healthcare

Saudi Arabia, with the largest economy in the GCC, is undergoing a profound transformation in its healthcare sector under Vision 2030. Driven by population growth and rising life expectancy, which rose to 78.8 years in 2024, healthcare has become a cornerstone of the Kingdom’s development strategy. National reforms are focused on expanding accessibility, enhancing quality, and accelerating digital integration to ensure care remains patient-centred, sustainable, and aligned with global benchmarks.

Survey results show that most respondents visit healthcare facilities several times per year, reflecting greater awareness of preventive care and access to private providers. High-income nationals are the most active users of private clinics, while public facilities continue to serve the broadest base of patients nationwide.

Riyadh and Jeddah remain the leading destinations for medical treatment, attracting patients from across the Kingdom due to their concentration of specialist hospitals and advanced healthcare infrastructure. Regional cities such as Dammam and Medina are emerging alternatives as healthcare provision becomes more decentralised.

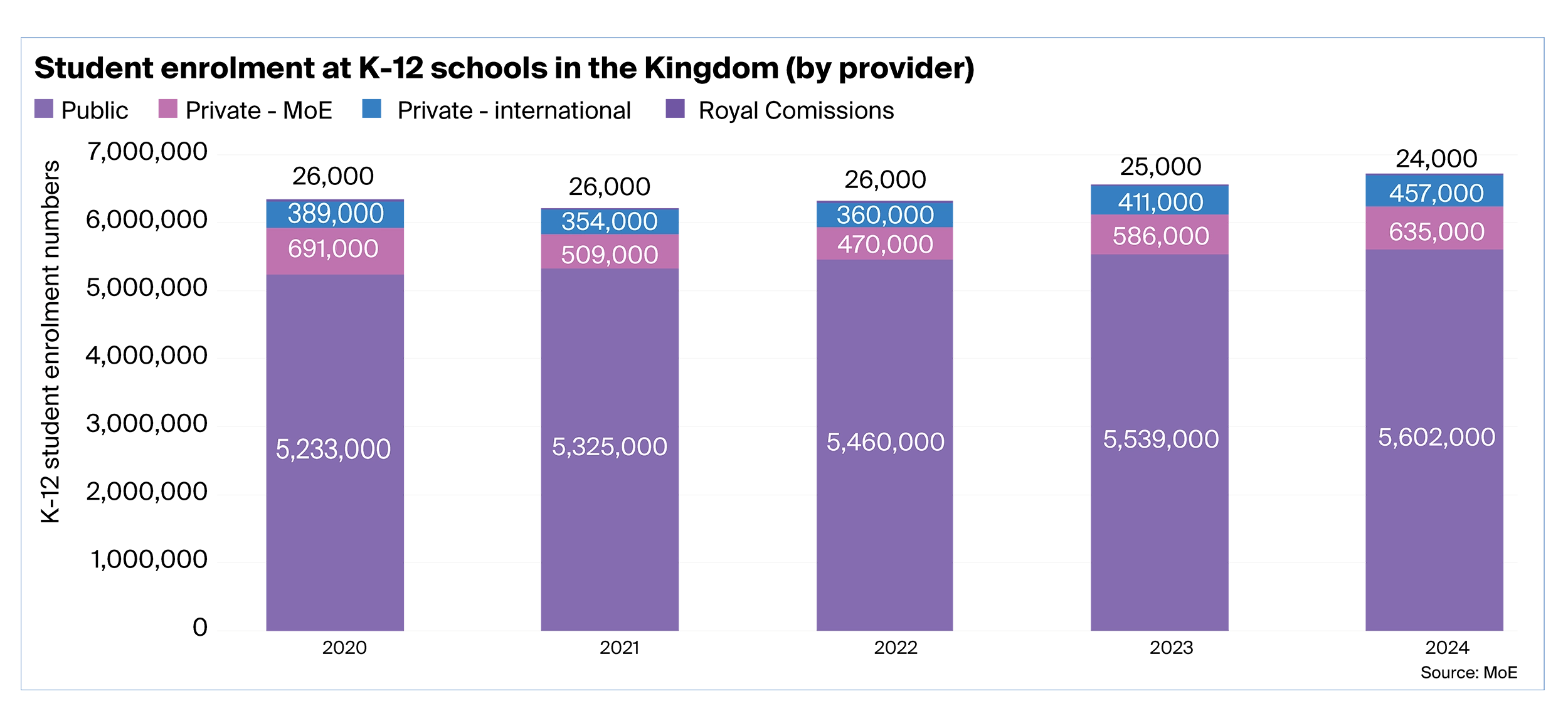

Education

The K-12 education system in the Kingdom is governed by the Ministry of Education (MoE). It is structured into kindergarten, six years of primary education, three years of intermediate schooling, and three years of secondary education. As of 2024, approximately 6.7 million students were enrolled across these levels, comprising roughly 5.6 million in public schools (83%) and around 1.1 million in various private institutions (17%), including those offered by the MoE curriculum, various international curricula and those licensed by Royal Commissions across the country’s various provinces (MoE).

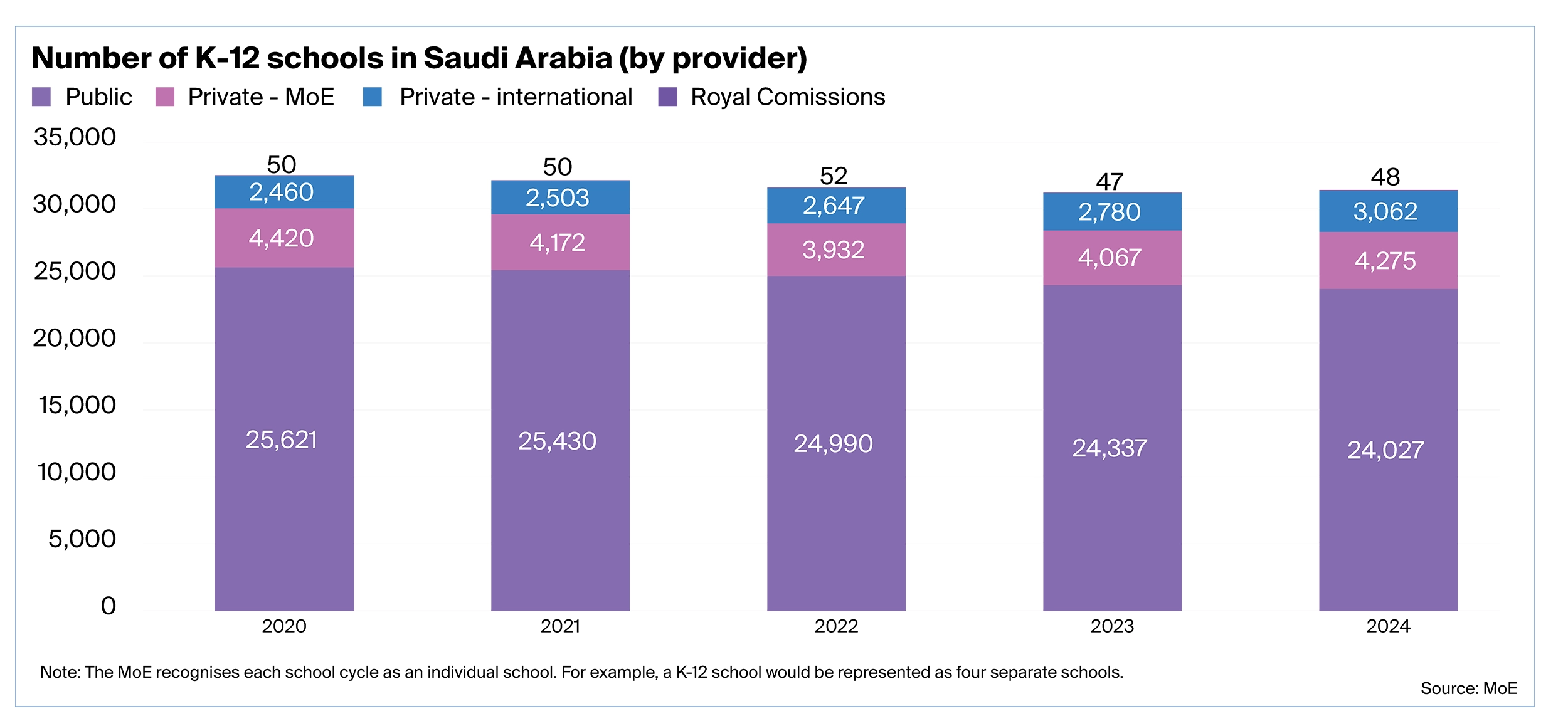

Saudi Arabia’s student population continues to expand, with enrolment dominated by public schools but a growing share of families turning to private and international curricula. This trend reflects rising household incomes, quality-driven preferences, and the government’s focus on educational diversification.

The number of schools across the Kingdom continues to increase in step with enrolment growth. Private and international providers are adding capacity at a faster pace than public institutions, contributing to a more varied and competitive education landscape aligned with Vision 2030 objectives.